Kestrel Structured

Capital Fund (KSC)

The Kestrel Structured Capital Fund (KSC) was launched to provide wholesale investors superior risk-adjusted returns with income, structural protection and exposure to the upside from investing in "lightly banked" Australian businesses.

Please note the following information has been prepared for the use of Wholesale and Professional Investors only.

What is Structured Capital?

Structured investments blend elements of debt and equity, providing contractual returns and downside protection. They can take various forms, including corporate debt facilities or individual corporate loans (first ranking or subordinated) with attached warrants, options, or conversion rights.

Structured financings are often used as a primary capital source or combined with equity raising and traditional debt to optimise capital structures and enhance shareholder value. While they have a higher cost of capital compared to traditional bank debt or inventory/receivable financing, they result in less shareholder dilution than pure equity issuance.

Structured financings are ideal for funding acquisitions, aggressive organic expansion, and infrastructure projects needing capital access for at least 18 months to achieve their value objectives. However, they may not be suitable for early-stage businesses that might struggle to meet the contractual rate of return and exit payments.

What we invest in

Sector agnostic, excluding bio-technology, property, retail

Industry

Real revenue from real customers

Commercial Growth

Sophisticated companies with market capitalisation of up to $500m

Scale

Predominately listed companies, 30% NAV total unlisted exposure

ASX focus

Diversified by sector, 30% NAV supply chain limit, where substantial interdependence exists

Risk

Investment Team

Risk-Based Investment Process

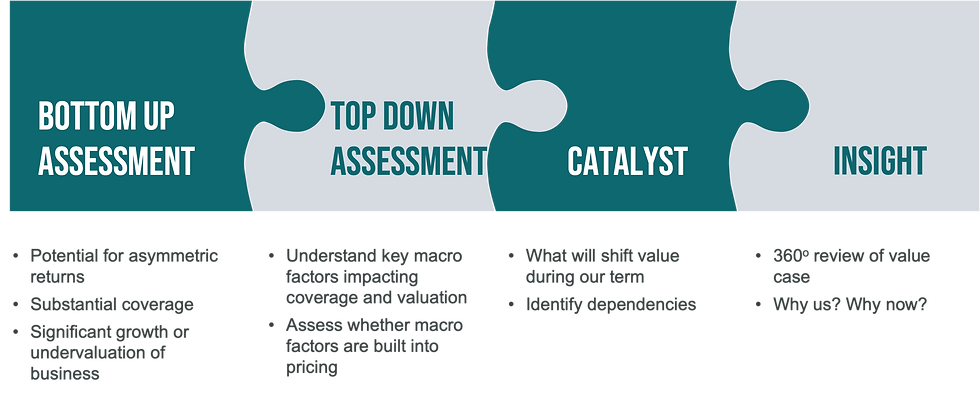

We adopt a fundamental approach seeking to build a complete picture of value with stage gates. Security is typically first-ranking.

Kestrel's Unique Approach

Our commitment to flexibility and alignment drives our approach. This flexibility is reflected in our pricing, which we believe is a strategic advantage. We employ sophisticated structures to optimise capital utilisation, including options like balloon payments and payment in kind.

Our efficient processes, including strategic outsourcing, expedite funding from initial engagement, ensuring swift and informed investment decisions. We emphasise a bottom-up valuation of the business and time spent with management to understand the business and its customers.